Disclosure: I received this complimentary product through the

HOMESCHOOL REVIEW CREW.

We were blessed to receive BUCK, FIRST BANK ACCOUNT from Buck Academy for review. You may remember our previous review of BUCK Making Cents.

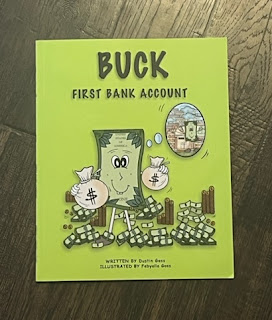

Our softcover book

Our

book is 25 pages and includes a bank account comparison and assessment, glossary, and a page about the author, Dustin Goss, and illustrator, Febyolla Goss. This husband and wife duo teamed up to help parents educate children on personal finance with Buck Academy and it's great!

The purpose of this book specifically is to guide and teach youth (young children, tweens and teens alike) about setting up their first bank account. It helps them think about the type of account they may need, a savings account vs a checking account and the details involved in setting one up. It's also helpful for parents in how to go about helping your child set up an account and what documents will be needed to do so.

BUCK, the friendly dollar bill, will help youth understand if they are a spender or a saver. I really like that it encourages kids to give, spend and save and it tells them that the percentages of how they do that will most likely change as they get older and that your youth is a fantastic time to really begin to save!

Other topics within our book include choosing a bank, the difference between a checking and savings account, what is a debit card and the risks involved with using one, etc.

Money awareness and understanding will definitely help children on their way to financial independence! This is another winner from Buck Academy and we definitely recommend it.

1 comment:

I also liked how the book encouraged giving and saving as well as some spending. It's more realistic and a great life skill to develop.

Post a Comment